If you're building a point-of-sale (POS) terminal, peer-to-peer platform, checkout flow, ATM network, or crypto payment solution, you're likely asking the same question: how do we bring stablecoins into the mix, without compromising speed, security, or compliance?

The answer: WalletConnect.

WalletConnect is quickly becoming the infrastructure standard for crypto and onchain payments, powering over $400 billion in annual network volume and helping businesses launch stablecoin checkout flows across wallets, regions, and platforms.

This isn’t just another integration. It’s a shift in how the next generation of payments is built.

Introducing WalletConnect Pay: From Basic Transfers to Full-Featured Crypto Checkout

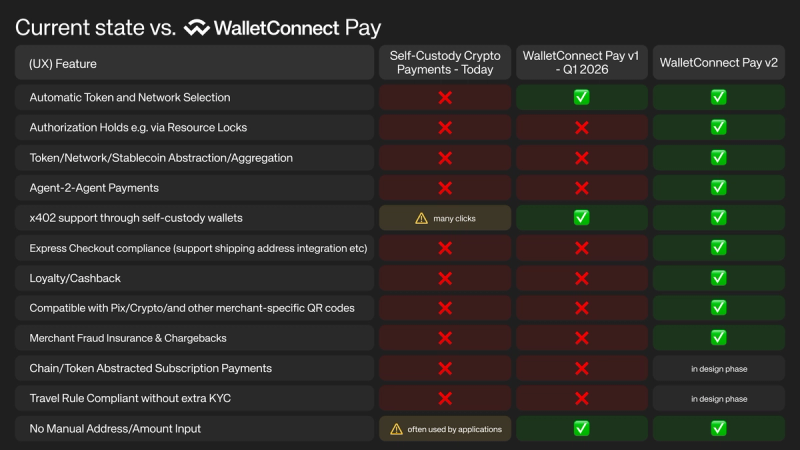

Today, most crypto payments are limited to basic value transfers. They lack the feature depth that merchants and users have come to expect from traditional systems like Visa or Apple Pay.

WalletConnect Pay is changing that, turning fragmented crypto checkouts into full-featured, merchant-grade payment flows.

Launched in 2025 and evolving into 2026, WalletConnect Pay introduces the primitives needed for crypto payments to reach feature parity with card networks. And in the process, it unlocks advantages that card rails can’t offer.

WalletConnect Is Now Live in Retail via dtcpay

dtcpay, a licensed Major Payment Institution (MPI) in Singapore, is now the first MPI to integrate WalletConnect into its point-of-sale network.

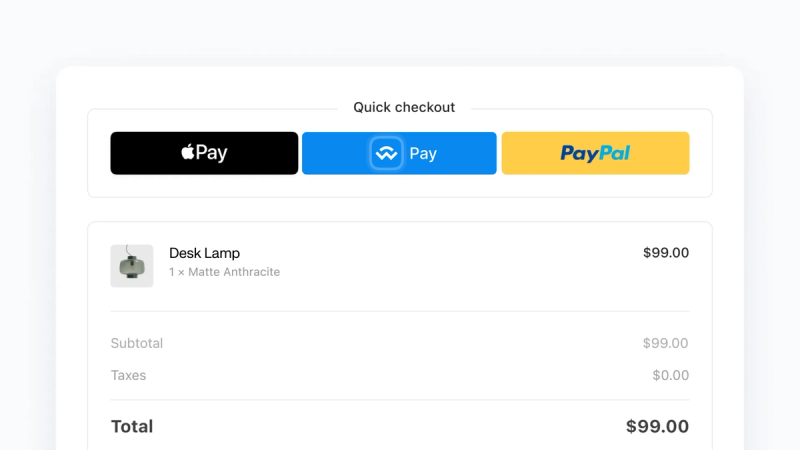

Merchants can now accept USDC, USDT, and other stablecoins using the exact same terminals they already trust. Users simply scan a QR code to pay with their wallet, no extra apps, no new hardware.

“Together, we are making onchain payments as intuitive and trusted as card payments, while opening new possibilities for merchants, institutions, and consumers worldwide,” said Band Zhao, Group Chairman of dtcpay .

The rollout is already underway across Asia, with more POS providers integrating soon.

This is stablecoin utility in the real world. No extra steps. No app switching. Just scan and pay.

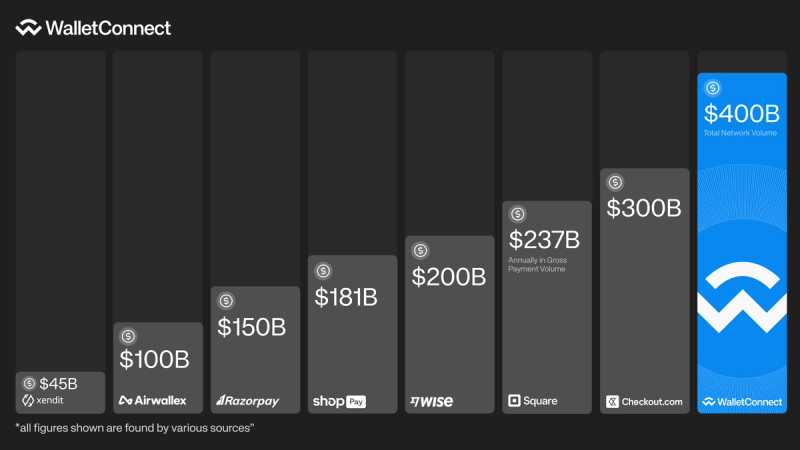

WalletConnect Is Already Handling More Volume Than Most Fintech Giants

The WalletConnect Network is projected to surpass $400 billion in annual Total Network Volume (TNV) across payment, wallet, and app integrations. That makes it one of the largest active crypto infrastructure networks globally.

To put that in perspective:

- Square (Block, Inc.): $231 billion annually in Gross Payment Volume (Q2’2024-Q1’2025). (Source Square)

- Checkout.com:$300 Billion (Projected) (Source: Checkout.com)

- Airwallex: $100 billion (Source Airwallex)

- Wise: $145 billion cross-border volume. (Source Wise Plc)

- Shopify Payments: $292.3 billion GMV based on Q4 2024 Business Overview (Source Shopify)

- Razor Pay: $150 Billion (Source: Razor Pay)

- Xendit: $45 Billion (Source: Xendit)

WalletConnect is already facilitating more value than most traditional fintech platforms, and it's growing fast.

Why Builders Are Choosing WalletConnect for Onchain Checkout

If you're building a crypto checkout or stablecoin acceptance, WalletConnect gives you everything you need to launch fast and scale globally.

Here's what makes it different:

- Stablecoin payments, made simple: Accept USDC, USDT, and other assets via wallets your users already have.

- 700+ wallets supported out of the box: From Binance Wallet to MetaMask to OKX.

- POS-compatible: Use WalletConnect with your existing point-of-sale setup. No hardware upgrades.

- Built for compliance: End-to-end encrypted, zero user credential exposure.

- Battle-tested: Trusted by apps and wallets powering the majority of global onchain volume.

Who This Is For

You’ll benefit from WalletConnect if you’re building:

- A crypto point-of-sale terminal

- A merchant platform or checkout service

- A stablecoin-powered ATM

- A cross-border payment solution

- A remittance or P2P app

- A DeFi or NFT checkout flow

WalletConnect makes each of these work at scale, across regions and regulatory environments.

How WalletConnect Works for Stablecoin Payments

The WalletConnect Network is built for interoperability and scale. Here's how it enables stablecoin flows across any app or merchant:

- User scans a QR code or taps to pay with their wallet.

- Transaction is signed and confirmed, using their existing stablecoin balance.

- Settlement occurs onchain, with no reliance on PSP-exchange integrations.

- Merchants receive funds instantly into supported accounts or wallets.

This flow works across desktop, mobile, embedded apps, and kiosk-based POS systems. It's the most flexible way to accept stablecoins today.

The Infrastructure Behind WalletConnect

At its core, WalletConnect is:

- A chain-agnostic connectivity layer, not just a protocol

- Trusted by 75,000+ apps and 700+ wallets

- Powering 350 million wallet-to-app connections and 50+ million users

- Architected with compliance and speed in mind

It’s already embedded in major wallets like Fireblocks, Ledger, Robinhood, Blockchain.com, OKX, Binance Wallet, and Gemini Wallet.

And now, it’s making onchain payments work at scale.

Ready to Build? We’ll Help You Move Fast

If you’re building anything in stablecoin payments, crypto checkout, or merchant enablement, we’re here to help.

- Plug into 700+ wallets

- Reach millions of users

- Launch faster with ready-to-integrate flows

- No PSP lock-in. No credential exposure. Just payments that work.

Talk to sales

Contact our team at [email protected] to start building with WalletConnect today. Or fill out the form below