Read the full paper: https://payments.walletconnect.com/

Onchain payments are broken. UX is clunky. Trust is low. And until now, crypto checkout has lagged significantly behind the seamless experiences of Apple Pay, Visa, and other payment methods we use without thinking. We are used to tapping, swiping, and inputting a PIN, and that's it.

WalletConnect is about to change this on a global scale.

With WalletConnect Pay, we are not just catching up to traditional rails, we’re leapfrogging them. This isn’t a feature update. It’s a full-stack rewrite of how crypto payments work, designed to bring agent-driven, token-abstracted, fraud-protected transactions to every wallet and merchant on the planet.

Think one-click approvals instead of endless wallet prompts. Token aggregation instead of “wrong network” errors. And yes, tap-to-pay crypto in stores. Built-in.

With WalletConnect Pay, the team behind the most trusted infrastructure in crypto is building the next generation of onchain payment rails. Not a patch. Not a plugin. A full-stack, programmable payments layer designed to beat the old system on its own terms: speed, security, simplicity, and cost.

If you're building onchain, here's what you need to know.

WalletConnect Just Make Crypto Payments Actually Work

You already know WalletConnect. It powers more than 700+ wallets and over 75,000+ apps. If you’ve ever scanned a QR code to connect a wallet, you’ve probably used it.

What most people don’t know is that WalletConnect has quietly become the connectivity layer for the financial internet, set to power over $400B in 2025 alone. And now, it’s introducing a full payments stack designed to bring that same reliability and reach to crypto checkout.

Here’s the best part: WalletConnect Pay isn’t just making crypto payments possible. It’s making them usable. In every wallet, at every checkout, all onchain payments will be on WalletConnect.

Why Crypto Payments Are Still Broken (and Why It Matters)

Even as stablecoin adoption grows, onchain checkout still trails far behind traditional rails. Today’s flows ask users to:

- Pick a network

- Choose a token

- Connect a wallet

- Confirm multiple times

- Pray it works

This is where WalletConnect steps in: to collapse complexity, boost conversion, and make crypto payments actually competitive with Apple Pay and Visa.

WalletConnect Pay: A Full-Stack Rewrite of Crypto Payments

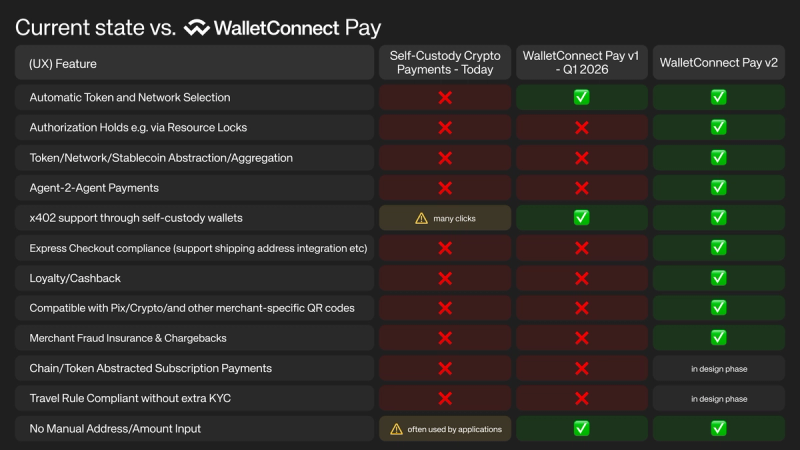

WalletConnect Pay is launching in two major phases, each focused on removing friction and unlocking new capabilities.

Phase 1 (Q1 2026):

- Automatic token and network selection

- Embedded HTTP checkout (x402 support)

- Wallet-side optimization (no more dropdowns, no more “wrong network” errors)

- One-click approvals instead of multi-step transactions

Phase 2:

- Authorizations (for recurring payments and delayed settlement)

- Loyalty and cashback support

- Express checkout flows (wallet-native address + shipping)

- Chain-abstracted subscriptions

- QR and POS compatibility worldwide

- Fraud protection and merchant insurance

- Tap-to-pay NFC wallet support

This isn’t catch-up. It’s leaps ahead.

WalletConnect Pay combines feature parity with card networks and crypto-native benefits like agent-driven flows, programmable logic, and lower transaction costs.

What WalletConnect Pay Means for Everyone

Stablecoins Are Already Bigger Than Visa, and Still Growing

Stablecoins aren’t emerging; they’ve arrived. In early 2025, stablecoin transaction volume surpassed $35 trillion, officially outpacing Visa’s payments volume for the first time (source). That momentum isn’t slowing down. Stablecoins now account for nearly 30% of all onchain activity, with over $4 trillion settled in the first half of the year alone (source). This isn’t just a trading tool anymore; it’s how millions of people pay, save, and move money globally. WalletConnect Pay is purpose-built to meet that scale, giving users and merchants a way to transact in stablecoins without friction, credential risk, or UX dead ends.

What WalletConnect Pay Means for End Users

Onchain payments are finally catching up to how users expect to transact. With WalletConnect Pay, users no longer have to jump through hoops just to complete a simple purchase. There’s no need to pick networks, swap tokens, or double-check contract addresses. No matter the wallet provider, the flow is fast, secure, and seamless. For the first time, crypto payments just work and that allowing daily, repeat usage beyond early adopters.

What WalletConnect Pay Means for Checkout Flows

WalletConnect Pay rewrites the playbook for crypto checkout. Instead of clunky, multi-step processes, merchants and platforms get a single, embedded flow that handles everything, network and token selection, user approvals, and even wallet-side metadata like shipping addresses. It reduces drop-offs, boosts conversion, and fits naturally into any e-commerce stack. With support for recurring payments, authorizations, and loyalty programs coming in v2, this isn’t just a crypto checkout; it’s a better one.

What WalletConnect Pay Means for Point of Sale (POS)

For physical merchants, onchain payments have always felt out of reach. WalletConnect changes that. With upcoming support for QR compatibility (Pix, Mercado Pago, Toast) and tap-to-pay NFC wallet support, WalletConnect brings crypto into the real world, no custom hardware, no integration lock-in. Payments happen through the user’s wallet in seconds, with the same protection, clarity, and fraud handling expected from legacy systems. It's crypto-native POS, without the trade-offs.

What WalletConnect Pay Means for Wallets

Wallets gain a major new role in the payment stack. Instead of acting as passive signature tools, wallets become the interface for smart, compliant, and user-friendly payment flows. With WalletConnect Pay, wallets can now aggregate tokens across chains, support programmable agent payments, embed express checkout flows, and unlock new monetization streams like loyalty or cashback. This isn’t just a UX improvement, it’s a strategic shift that puts wallets at the center of onchain commerce.

A Win for Every Player in the WalletConnect Pay Stack

For merchants:

Lower fees, no intermediaries, crypto-native users, and better margins—without sacrificing the core features of card-based systems.

For wallets:

Direct integration into a compliant, feature-rich payments standard. Plus new revenue opportunities via loyalty, cashback, and staking rewards.

For PSPs:

A future-proof way to support both card and crypto checkout. WalletConnect already powers flows for Shopify, Stripe, Shift4, Coinbase, and more.

For developers:

Open standards. Composable primitives. Real-time data. And the ability to build new flows that card networks can’t even support.

The WalletConnect Network: Built to Scale with the Onchain Economy

The onchain internet is here. But until now, its payment and checkout layer has been missing.

WalletConnect Pay changes that by delivering the payment experience users expect, with the decentralization, ownership, and composability they deserve.

It’s not just about replacing traditional rails. It’s about building something better.

And that’s exactly what WalletConnect is doing.

Read the full paper: https://payments.walletconnect.com/